Tesla’s Stock Faces Turbulence Amid Market Challenges

As of March 11, 2025, Tesla Inc. (NASDAQ: TSLA) is undergoing significant market fluctuations, driven by internal leadership issues, competitive pressures, and regulatory challenges. Below is a detailed analysis of Tesla’s stock performance, integrating real-time financial data, technical indicators, and expert insights to provide a comprehensive outlook.

Current Stock Performance

At the latest market close, Tesla’s stock price is trading at $222.15, marking a steep decline of $40.53 (-15.43%) from the previous session. This sharp drop reflects broader market concerns, including investor uncertainty and sector-wide volatility in electric vehicle (EV) stocks.

Key Stock Metrics:

| Metric | Value |

| Current Stock Price | $222.15 |

| Daily Change | -$40.53 (-15.43%) |

| 52-Week High | $497.50 |

| 52-Week Low | $139.01 |

| Market Cap | $738.94 Billion |

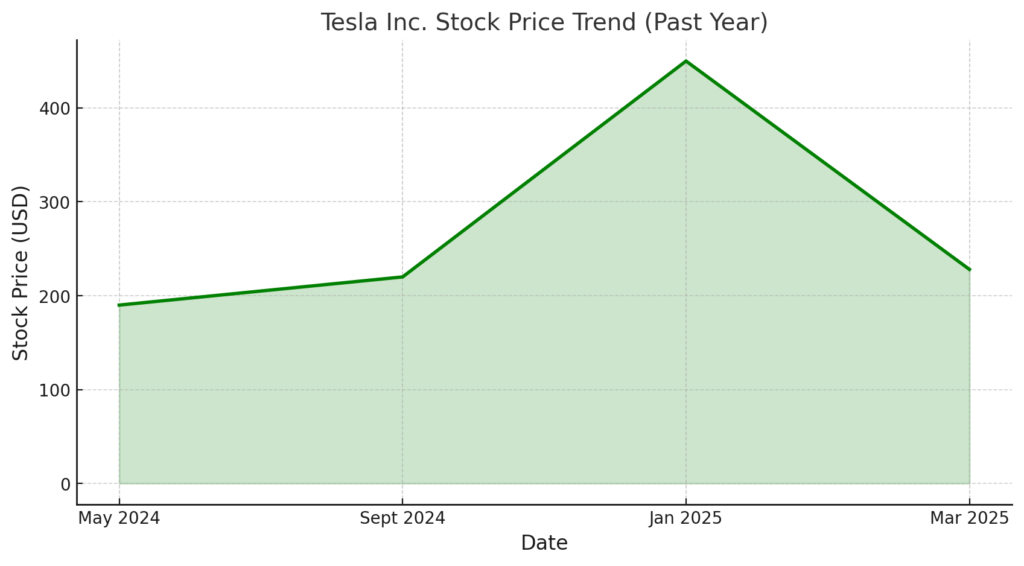

Over the past year, Tesla Inc. (TSLA) has experienced significant stock price fluctuations. Here’s a summary of its performance:

March 31, 2024: Opened at $177.45 and closed at $175.79.

December 17, 2024: Reached an all-time high closing price of $479.86.

March 10, 2025: Closed at $222.15, marking a 15.4% decline from the previous day.

As of March 11, 2025, TSLA is trading at $228.39, reflecting a slight recovery from the previous day’s drop.

Recent Stock Price Movement

Over the past three months, Tesla’s stock has suffered a 55% decline from its all-time high in mid-December 2024. This dramatic downturn has wiped out nearly $795 billion in market capitalization, pushing Tesla down the rankings behind industry giants like Berkshire Hathaway and Saudi Aramco.

Comparative Market Capitalization (2025)

| Company | Market Cap (Trillion $) |

| Apple | 2.5T |

| Microsoft | 2.3T |

| Saudi Aramco | 1.8T |

| Berkshire Hathaway | 1.1T |

| Tesla (Current) | 703B |

Expert Take:

“Tesla’s sharp decline is a reflection of increased competition in the EV market and regulatory scrutiny. Investors are closely watching its response to market headwinds.” – Dan Ives, Wedbush Securities

Technical Analysis

From a technical perspective, Tesla’s stock has fallen below its 200-week moving average, a crucial support level. The high trading volume during this downtrend suggests institutional investors are actively offloading shares.

Key Technical Levels:

- Support Levels: $215, $165

- Resistance Levels: $265, $300

- Relative Strength Index (RSI): 36 (Oversold territory)

📉 Technical indicators suggest the stock may be approaching a potential rebound zone.

Factors Influencing Stock Performance

Tesla’s stock decline is attributed to multiple macroeconomic and company-specific factors:

1. Leadership Controversies

CEO Elon Musk’s political engagements and controversial statements have raised concerns among investors. The fallout has resulted in a sell-off as investors fear reputational damage affecting Tesla’s brand value and sales.

2. Competitive Pressure

Tesla is facing stiff competition from BYD, which surpassed Tesla in global EV sales (Q4 2024). Traditional automakers like Ford, GM, and Volkswagen are aggressively expanding their EV production, further intensifying market rivalry.

📊 EV Sales Comparison (Q4 2024)

| Company | EV Sales (Million Units) |

| BYD | 3.4M |

| Tesla | 3.2M |

| Volkswagen | 2.1M |

| GM | 1.8M |

| Ford | 1.5M |

3. Regulatory Scrutiny

Tesla is under increased scrutiny from U.S. and European regulators over its Full Self-Driving (FSD) technology. Stricter safety laws and potential recalls could impact Tesla’s roadmap for autonomous vehicles and investor sentiment.

Future Outlook & Growth Opportunities

Despite ongoing challenges, analysts suggest Tesla has strong long-term potential, fueled by technological advancements and market expansion strategies.

1. Affordable EV Launch

Tesla plans to begin production of a budget-friendly EV under $30,000 in mid-2025, aiming to drive mass adoption and counter slowing EV sales growth.

2. AI & Autonomous Driving Innovations

Tesla continues to invest in AI-powered autonomous driving, aiming to strengthen its technological edge. Analysts predict self-driving breakthroughs could significantly enhance Tesla’s stock valuation over the next 5-10 years.

📈 Projected Tesla Stock Growth Based on Innovation

(Source: Morgan Stanley Research)

| Year | Projected Stock Price ($) |

| 2025 | $250-280 |

| 2026 | $320-350 |

| 2027 | $400+ |

Conclusion: Should Investors Buy Tesla Stock Now?

Tesla’s stock is currently in a high-volatility phase, with strong downside risks and potential upside opportunities. Analysts recommend a wait-and-watch approach, focusing on: ✅ Product diversification & innovation

✅ Regulatory developments in autonomous driving

✅ EV demand trends amid global economic slowdown

📌 Final Verdict: Short-term uncertainty remains, but long-term investors may find value in Tesla’s technological edge and growth prospects.