The International Monetary Fund (IMF) recently released its World Economic Outlook (WEO) report, projecting India’s economic growth at 7% for the current fiscal year ending March 31, 2025, and 6.5% for FY 2025-26. This reflects India’s strong economic resilience amidst global uncertainties.

What is the IMF?

The International Monetary Fund (IMF) is a specialized agency of the United Nations, established to promote global monetary cooperation, financial stability, and international trade, while supporting employment and sustainable economic growth worldwide.

- Founded: 1944, at the Bretton Woods Conference (alongside the International Bank for Reconstruction and Development (IBRD), now known as the World Bank).

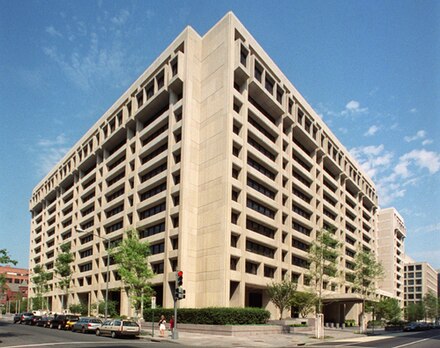

- Headquarters: Washington, D.C., USA.

- Member Countries: 190, with India as a founding member. The Principality of Andorra became the 190th member in late 2020.

- Membership Requirement: A country must first join the IMF to become a member of the World Bank.

Organizational Structure of IMF

Board of Governors

The Board of Governors is the highest decision-making body in the IMF, consisting of:

- One Governor and One Alternate Governor from each member country.

- In India, the Finance Minister serves as the Ex-officio Governor, while the Governor of the Reserve Bank of India (RBI) is the Alternate Governor.

Managing Director

The IMF is led by a Managing Director, who is the Chief Executive Officer (CEO), overseeing day-to-day operations.

Reports Published by IMF

The IMF publishes several influential reports, including:

- World Economic Outlook (WEO): Provides global economic analysis and projections.

- Global Financial Stability Report (GFSR): Assesses international financial markets.

- Fiscal Monitor: Analyzes public finance developments worldwide.

- Global Policy Agenda: Outlines IMF’s priorities and policy advice.

- Artificial Intelligence Preparedness Index (AIPI) Dashboard: Assesses countries’ readiness for AI integration.

Financial Mechanisms and Instruments of IMF

1. Structural Adjustment Programmes (SAPs)

- Introduction: Launched in the 1980s by the IMF and World Bank to address economic instability and promote sustainable growth.

- Objective: To correct structural imbalances through economic reforms such as fiscal discipline, privatization, and trade liberalization.

2. Extended Fund Facility (EFF)

- Purpose: Assists countries with medium-term Balance of Payments (BoP) issues.

- Recent Example: In 2023, the IMF approved a $7 billion EFF for Pakistan to support its struggling economy.

3. Rapid Financing Instrument (RFI)

- Purpose: Provides quick financial assistance to countries facing urgent balance of payments needs, such as during natural disasters or economic crises.

4. Rapid Credit Facility (RCF)

- Target Audience: Low-income countries.

- Purpose: Offers immediate financial support for BoP needs without requiring a full economic program.

5. Washington Consensus (IMF Conditionalities)

- Definition: A set of economic policy reforms required by the IMF as conditions for loan approval.

- Examples of Conditions:

- Fiscal austerity

- Privatization

- Trade liberalization

- Implementation: Loans are disbursed in tranches (installments) linked to the implementation of policy reforms.

IMF’s Role in Global Economic Stability

A. Promoting International Trade and Growth

The IMF plays a crucial role in fostering global trade by ensuring exchange rate stability and providing financial assistance to countries facing economic challenges.

B. Financial Surveillance and Policy Advice

Through its surveillance mechanism, the IMF monitors global economic trends and advises member countries on macroeconomic policies, such as fiscal, monetary, and exchange rate policies.

C. Capacity Development and Technical Assistance

The IMF provides technical assistance and training to member countries, helping them strengthen their economic institutions and capacity to manage crises.

Economic Growth Projections:

World Economic Outlook (2025-26)

| Country/Region | Projected Growth (2024-25) | Projected Growth (2025-26) |

|---|---|---|

| India | 7.0% | 6.5% |

| China | 4.5% | 4.2% |

| United States | 1.8% | 1.9% |

| Euro Area | 1.2% | 1.4% |

| Global Economy | 3.0% | 3.1% |

Source: IMF World Economic Outlook Report

Chart: IMF Growth Projections for Major Economies

A bar chart comparing growth projections for India, China, USA, Euro Area, and the Global Economy can visually represent the economic outlook. (Chart can be created if required)

Expert Opinions

- Gita Gopinath, First Deputy Managing Director, IMF:“India’s economic growth projection of 7% for 2024-25 showcases its strong domestic demand and policy resilience amidst global headwinds.”

- Raghuram Rajan, Former RBI Governor:“The IMF’s positive outlook on India reflects its robust macroeconomic fundamentals, but structural reforms are needed to sustain long-term growth.”

Challenges and Criticisms of IMF Policies

1. Conditionalities and Sovereignty Concerns

IMF’s Washington Consensus conditions often require structural reforms, leading to criticism of influencing domestic policies of borrowing nations.

2. Debt Dependency and Austerity Measures

- IMF loans are sometimes criticized for enforcing austerity measures that can lead to reduced public spending and social welfare programs, impacting vulnerable populations.

- Example: Greece’s debt crisis, where IMF-imposed austerity led to economic contraction and social unrest.

IMF and India: A Strategic Partnership

- India is a founding member of the IMF and has actively contributed to its policy discussions.

- The IMF’s positive growth projections reinforce India’s role as a key driver of global economic growth.

- Policy Advice and Financial Assistance: The IMF continues to provide strategic policy advice and technical assistance to India in areas such as fiscal management, banking sector reforms, and digital economy integration.

- IMF World Economic Outlook 2025

- India Economic Growth Projections

- IMF Financial Mechanisms and Instruments

- IMF Structural Adjustment Programmes

- Washington Consensus IMF

- Global Financial Stability Report

Conclusion

The International Monetary Fund (IMF) plays a pivotal role in promoting global financial stability, fostering international trade, and supporting economic growth through its financial mechanisms and policy advice. Its latest World Economic Outlook projects India’s economic resilience, reinforcing its position as a leading growth engine in the global economy. With strategic partnerships, international cooperation, and adaptive policies, the IMF continues to navigate the challenges of an interconnected world economy.